Cooperative Structure

Raiffeisen’s cooperative structure and governance are differentiating in the Swiss market.

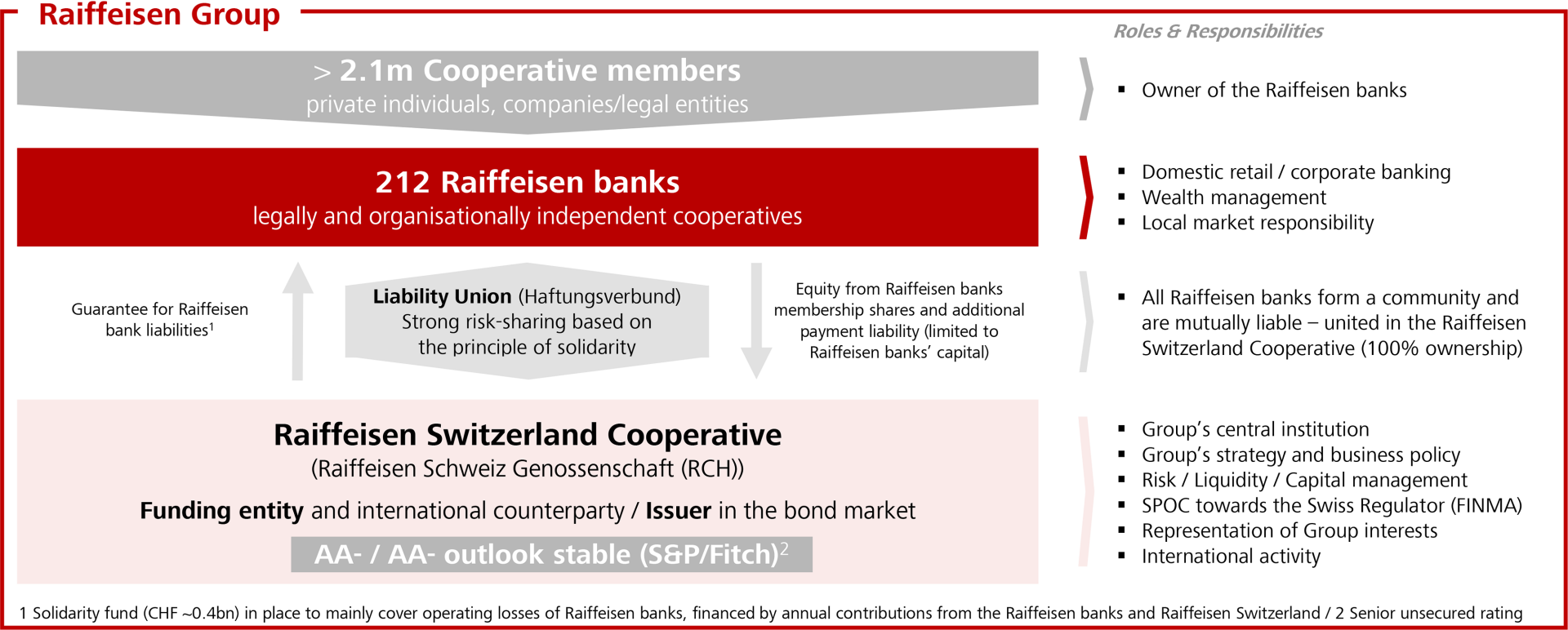

Raiffeisen Group

- Raiffeisen Group consists of 212 legally independent Raiffeisen banks, owned by more than 2 million cooperative members, and Raiffeisen Switzerland Cooperative (Raiffeisen Schweiz Genossenschaft), the group’s central institution, which is owned by the Raiffeisen banks. Consequently, the Raiffeisen Group is a banking network, not a legal entity.

- The Raiffeisen banks operate predominantly in their geographic region, focusing on retail and SME clients, whereas Raiffeisen Switzerland Cooperative performs strategic and supervisory functions for the entire Raiffeisen Group, oversights the Raiffeisen banks’ risk profiles and acts as issuer of capital and liquidity instruments in the financial market.

- Group cohesion is underpinned by a mutual-support mechanism – including a solidarity fund supporting failing Raiffeisen banks and a cross-guarantee between local Raiffeisen banks and Raiffeisen Switzerland Cooperative, covering liabilities up to each bank’s equity.

Raiffeisen Switzerland Cooperative – the Group’s central institution

As the Group’s central institution Raiffeisen Switzerland Cooperative (Raiffeisen Schweiz) is responsible for:

- the Group’s business strategy and policy

- the overall coordination of Raiffeisen Group based on the strategic direction as well as legal, regulatory and supervisory provisions (incl. SPOC towards the regulator)

- the liquidity and capital management on group level (incl. monetary settlement, liquidity maintenance and refinancing (also acting as issuer in the bond market))

- the oversight of the Raiffeisen banks’ risk profiles

- the representation of the Group’s interests to authorities, associations and the public nationally and internationally

Board of Directors Raiffeisen Switzerland Cooperative

The Board of Directors (BoD) of Raiffeisen Switzerland Cooperative (Raiffeisen Schweiz Genossenschaft) oversees group strategy, financial management, and the Executive Board of Raiffeisen Schweiz. In accordance with the Articles of Association the BoD has 8–12 members, reflecting Switzerland’s linguistic regions and Raiffeisen’s banking bodies. Members are elected at the General Meeting (GM) for two-year terms (max 12 years) and must retire by the end of the term in which they turn 70.

Executive Board Raiffeisen Switzerland Cooperative

The Executive Board (ExB) of Raiffeisen Schweiz manages day-to-day operations and includes the Chairman and six members appointed by the BoD of Raiffeisen Schweiz. It can make decisions with a majority present (members or deputies), usually by consensus; if not, by absolute majority. In case of a tie, the Chairman has the casting vote.